Introduction

In today’s fiercely competitive business world, entrepreneurs face numerous challenges that require a solid understanding of financial literacy. By mastering key financial concepts and implementing effective strategies, business owners and leaders can make informed decisions, manage resources efficiently, and drive long-term success for their businesses.

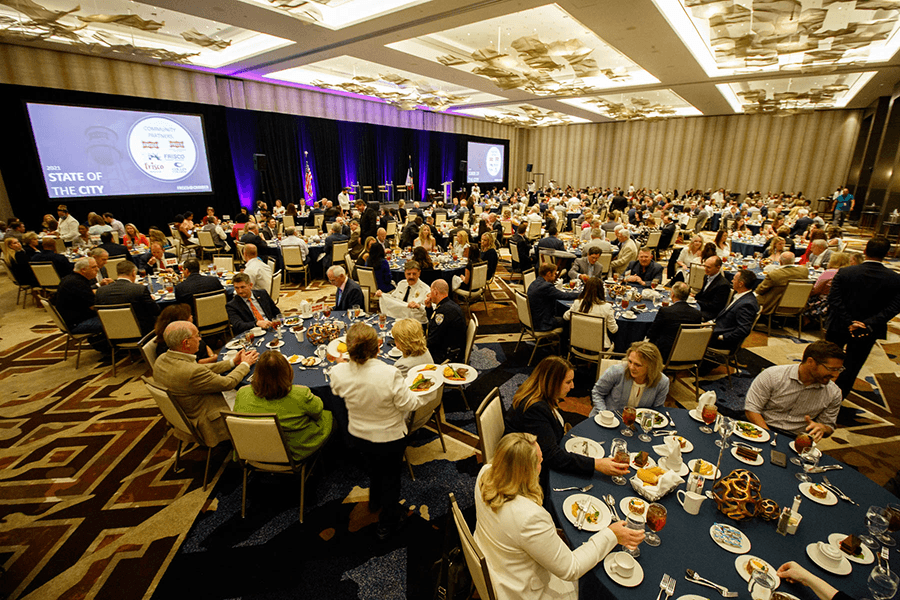

As part of the Frisco Chamber of Commerce 2021 to 2025 Strategic Plan, four key initiatives were identified – small business ecosystem, workforce issues, community non-profit assistance. The fourth initiative, financial literacy is woven into the three others.

Why Financial Literacy Matters

Financial literacy encompasses more than just balancing a checkbook. It is the foundation for understanding fundamental financial principles and concepts such as cash flow, budgeting, and financial statements. Developing financial literacy can bring significant benefits to entrepreneurs:

Making Better Investment Decisions: Financial literacy equips entrepreneurs with the knowledge to evaluate investment opportunities, assess risks, and allocate resources wisely.

Effective Cash Flow Management: Understanding cash flow dynamics enables entrepreneurs to ensure a steady inflow and outflow of funds, ensuring the business has enough liquidity to cover expenses and pursue growth opportunities.

Identifying and Mitigating Risks: Financial literacy empowers entrepreneurs to identify potential risks and take proactive measures to minimize their impact on the business, such as managing debt, diversifying revenue streams, and establishing emergency funds.

Attracting Investors and Partners: Investors and partners seek entrepreneurs who demonstrate a solid grasp of financial matters. Financial literacy helps entrepreneurs communicate their business’s financial health, potential returns, and growth prospects effectively.

Fueling Business Growth: With financial literacy, entrepreneurs can analyze financial statements, identify areas for improvement, and make data-driven decisions to optimize operations, expand into new markets, and drive sustainable growth.

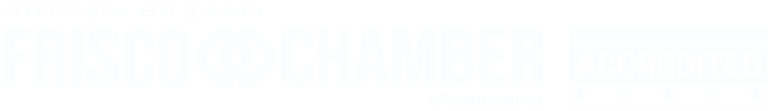

Small Business Owners

Source: vctia Financial Literacy Survey

Key Concepts in Financial Literacy

To build a strong financial foundation, business owners and leaders should grasp the following key concepts:

Cash Flow: Cash flow refers to the movement of money into and out of a business. Understanding cash flow dynamics allows entrepreneurs to effectively manage revenue, expenses, and working capital, ensuring the business remains financially stable.

Budgeting: Budgeting is the process of creating a financial plan that outlines expected income and expenses. It helps entrepreneurs allocate resources, track spending, control costs, and achieve financial goals.

Financial Statements: Financial statements, including the balance sheet, income statement, and cash flow statement, provide a snapshot of a business’s financial performance. Entrepreneurs who understand financial statements can assess profitability, liquidity, and solvency, enabling them to make informed decisions about resource allocation and growth strategies.

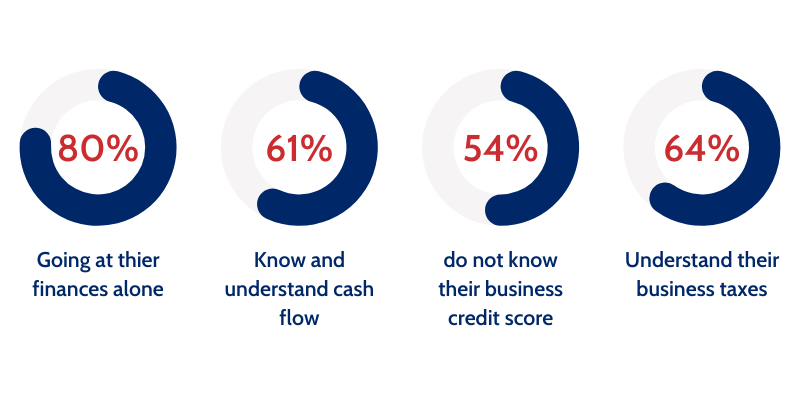

Source: vctia Financial Literacy Survey

Strategies for Enhancing Financial Literacy

To enhance financial literacy, entrepreneurs can leverage the following strategies:

Enroll in Financial Literacy Courses or Workshops: Explore online and in-person courses or Workshops that cover essential financial topics for entrepreneurs. These educational opportunities provide structured learning and practical insights from experts.

Collaborate with an Accountant or Financial Advisor: Engage the services of a qualified accountant or financial advisor who can offer personalized guidance, review financial statements, provide tax planning advice, and help entrepreneurs navigate complex financial decisions.

Read Books and Articles on Financial Literacy: A wealth of books and articles are available to deepen entrepreneurs’ financial knowledge. Recommended titles cover a wide range of topics, including personal finance, investing, financial management, and entrepreneurial success stories.

Engage in Financial Literacy Forums or Groups: Join online or in-person forums, communities, or networking groups focused on financial literacy for entrepreneurs. These platforms provide opportunities to learn from peers, share experiences, and gain insights into practical financial strategies.

Examples and Resources

Here are practical examples and resources that entrepreneurs can utilize to improve their financial literacy:

Examples

Set Specific Financial Goals: Establish measurable and time-bound goals, such as saving a certain amount of money, reducing expenses, or increasing profit margins. Regularly track progress and adjust strategies accordingly.

Monitor and Analyze Business Spending: Utilize budgeting apps or online financial tools to track and categorize business expenses. Regularly analyze spending patterns to identify areas where costs can be reduced or reallocated to maximize efficiency.

Create a Comprehensive Budget: Develop a detailed budget that aligns with your business goals and includes projected revenue, fixed and variable expenses, and contingencies. Review and update the budget regularly to ensure it remains relevant and supports financial stability.

Explore Investment Opportunities: Educate yourself about different investment options, such as stocks, bonds, real estate, or business expansion. Conduct thorough research, seek professional advice if needed, and consider diversifying your investment portfolio to mitigate risks and maximize potential returns.

Establish Financial Safety Nets: Protect your business and personal finances by building emergency funds, obtaining adequate insurance coverage, and implementing risk management strategies. Being prepared for unforeseen circumstances can help mitigate financial setbacks and maintain business continuity.

Resources

Books

The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It by Michael E. Gerber: This book provides a step-by-step guide to starting and running a successful business.

The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric Ries: This book teaches you how to test your ideas quickly, iterate on your products and services based on customer feedback, and build innovative businesses.

The Four Steps to the Epiphany: Successful Startups Distinguish Themselves from the Crowd by Steve Blank: This book helps entrepreneurs identify and solve real customer problems, guiding them in building businesses that stand out from the competition.

The Art of the Start: The Time-Tested, Battle-Hardened Advice for Building a Great Company by Guy Kawasaki: This book offers practical advice on finding your product-market fit, building a team, and raising capital.

Zero to One: Notes on Startups, or How to Build the Future by Peter Thiel: This thought-provoking book challenges conventional wisdom and offers a new perspective on how to build successful businesses.

Online Financial Literacy Resources

Intuit Quickbooks Self-Employed: This online accounting software helps entrepreneurs track income, expenses, and simplifies tax filing. Visit Quickbooks Self-Employed

Freshbooks: Another online accounting software that offers features for expense tracking, invoicing, and time tracking. Visit Freshbooks

Xero: A cloud-based accounting software that provides tools for tracking income, expenses, and generating financial reports. Visit Xero

Harvest: An online time tracking and invoicing software that helps entrepreneurs track billable hours, manage projects, and streamline invoicing. Visit Harvest

Wave Accounting: A free online accounting software that offers features for expense tracking, invoicing, and financial reporting. Visit Wave Accounting

Government Resources

Small Business Administration (SBA): The SBA provides loans, grants, and valuable resources to support small business growth. Visit their website for information and assistance: Visit SBA

Internal Revenue Service (IRS): The IRS website offers information and resources on tax obligations, deductions, and compliance requirements for small businesses: Visit IRS

U.S. Department of Labor: The Department of Labor provides guidance on labor laws, employee benefits, and compliance requirements for small businesses: Visit U.S. Department of Labor

U.S. Department of Commerce: The Department of Commerce offers resources and assistance to help entrepreneurs with business development, market research, and international trade: Visit U.S. Department of Commerce

Non-Government Organizations

SCORE: SCORE is a nonprofit organization that provides free mentoring, workshops, and resources for entrepreneurs: Visit SCORE

The National Foundation for Credit Counseling: This nonprofit organization offers credit counseling and debt management services to entrepreneurs: Visit NFCC

The American Institute of Certified Public Accountants: The AICPA provides resources and guidance on accounting, financial reporting, and tax matters for small businesses: Visit AICPA

- The National Association of Enrolled Agents: This professional organization offers resources and support for tax professionals who can provide valuable guidance to entrepreneurs: Visit NAEA

By utilizing these resources, entrepreneurs can enhance their financial literacy and make more informed decisions for their business’s success.

Conclusion

Financial literacy is a critical skill set that empowers entrepreneurs to navigate the complex financial landscape with confidence. By investing in their financial education, entrepreneurs can unlock opportunities, manage resources effectively, and steer their businesses towards sustainable growth. Continuously seek out learning opportunities, collaborate with experts, and leverage available resources to strengthen your financial literacy and secure a prosperous future for your business. Remember, financial literacy is the key that unlocks the doors to financial success in entrepreneurship.